Monetization Law Number #7

bundling and unbundling are powerful monetization tools

bundling and unbundling are the disruptive monetization gifts that keep on giving.

The waves of disruption have been assisted by the power of unbundling and bundling of product and services. This has proved to be a powerful tool in your business success.

This chapter is about how packaging your way to a bundle of monetization.

The Rule provides a quick monetization heuristic i.e. a rule of thumb in operation, a kind of —do this— and you’ll be 80% of the way there.

Rationale explains why the rule works with deeper insights and its use in practice.

Rabbit hole provides more in-depth resources and recommendations for anyone wanting to spend more hours researching each topic.

⓵ Rule 📖

⓶ Rationale 🧠

⓷ Rabbit Hole 🐇

⓵ Rule: Monetization Law #7 📖

Bundling and unbundling should be used to increase profits and customer satisfaction.

⓶ Rationale: Monetization Law #7 🧠

…to bundle or unbundle, that is the question

People buy solutions. The packaging of solutions has been a long-standing business model constituent. The disruption economy kickstarted in the web 1.0 era, has lent itself to the evolution of product packaging as an agent for increased monetization.

So what is bundling and unbundling? Bundling is when a series of products or services within a value chain are packaged together and sold as a whole. Unbundling is simply the reverse, i.e., breaking out constituent parts into individual or smaller re-packaged offerings. Software companies take this to a whole new level, but the concept is perhaps best explained by the airline industry.

Many moons ago, most airlines offered a fully bundled service. For example, the purchase of a plane ticket included many other related services such as food, refreshments, in-flight entertainment, luggage allowance, and a confirmed seat, yes, a confirmed seat next to your family! A fully bundled service.

New entrants to the airline market such a Ryanair saw the opportunity to disrupt the hegemony. Reasoning along the lines - what if people only valued getting safely to their destination, therefore having little or no willingness to pay for additional ‘niceties.’

By offering flight only services at discount prices - the discount airline market showed businesses the power of unbundling traditional value chains.

The Adobe cloud bundle

All hail Adobe, the mother of all bundles!

At the inception of the internet, HTML wreaked havoc with document attachments. The web re-sized documents at will with no guarantee of receiver readability.

–Enter Adobe, with their portable document format [PDF], to save the day.

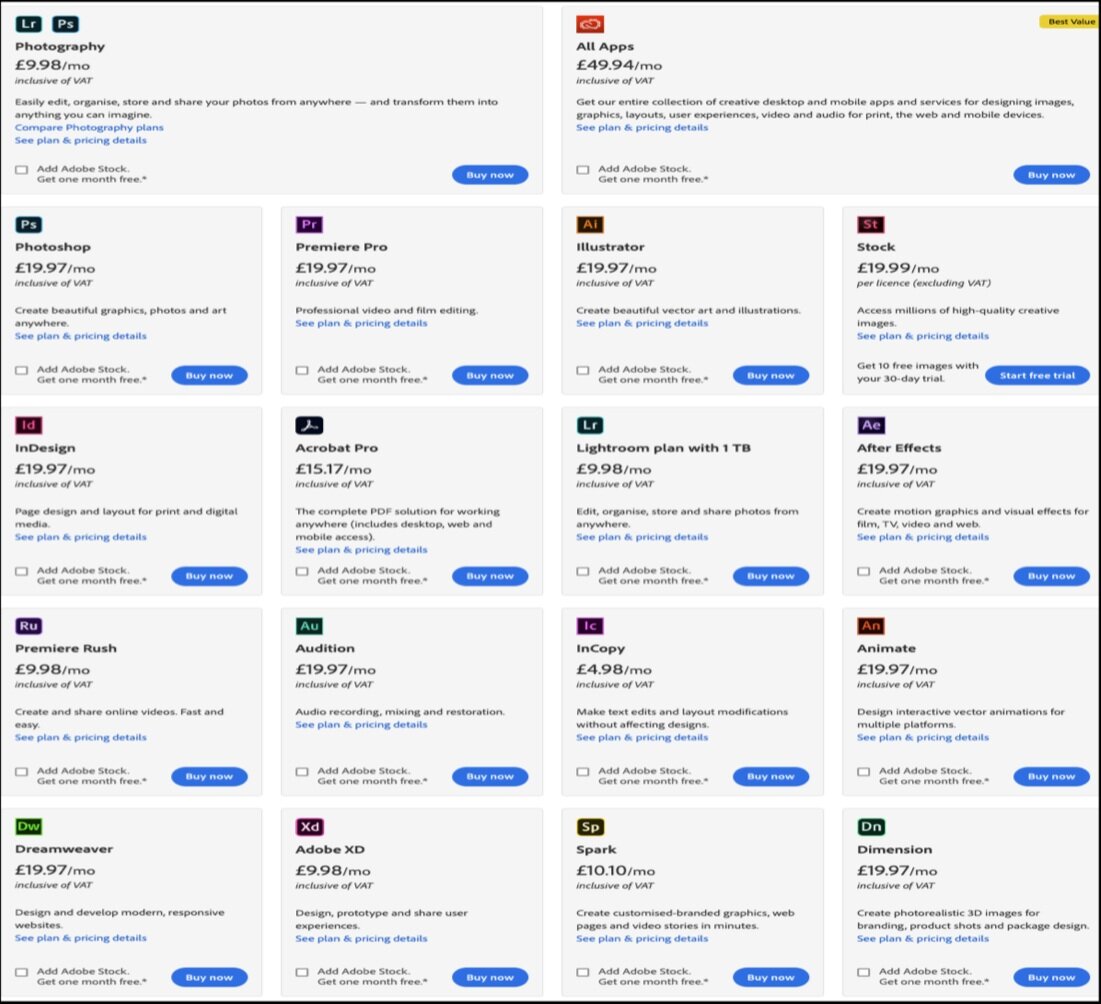

Alongside many other products, Adobe created a robust suite of software that sold in separate unit licenses.

Today, Adobe’s Creative Cloud bundle [see the central diagram] represents one of the best known, well-regarded monetization-enhancing packaged bundles on the market.

Jim Barksdale - Netscape [pioneering web browser company]

Amid a Netscape IPO roadshow, an analyst asked the question on everybody’s mind.

”Do you think that Microsoft will bundle an internet browser into their product offering?”

Jim Barksdale replied,

“Gentlemen, there are only two ways I know of to make money; bundling and unbundling.”

The audience stunned; he promptly left to catch a plane to the next roadshow meeting.

⓷ Rabbit Hole: Monetization Law #7 🐇

How to bundle: matrix 2 x 2

The bundling opportunity matrix can be viewed in terms of a 2x2 with the following segments:

–Unique Selling Point (USP); willingness to pay is high, as is the value placed on the feature. This feature forms the core of your differentiable offering and should be marketed on this basis.

–Core Features/Table Stakes; when the client's value is high, but they are unwilling to pay extra, this needs to be added as a core feature and built into the base price of the package. These are valuable features that everybody expects. The in-flight toilet charge suggested by a budget airline is a recent example.

–Add-Ons, when only a few customers value the feature, but those who do are willing to pay more for it; this is an add-on feature. Add-ons need to be limited to the options where the revenue you could bring in is worth the complications it will add. Charges for luggage in airlines or APIs in the software industry are examples.

–Wasted Features; when only a few clients value the feature, and there is little interest in paying more, this is a waste of your time. These frequently arise from a bespoke customer or client request.

2x2 Evaluation Matrix [[WTP=willingness to pay]]

Willingness to pay factors

A customer's willingness to pay will be affected by many factors including some of the following;

–The Economy; when the economy is doing well, WTP is likely to increase. A general recession or issues specific to your industry will cause WTP to decrease.

–Trends; for products and services with a high amount of seasonality or trendiness then WTP will vary

–Consumer’s personal circumstances and price sensitivity; every customer has a different price sensitivity and set of circumstances

–The uniqueness of the product or service or general scarcity; the less something is available, the more valuable it becomes. The last seat on the first flight to New York!

The quality of a product: the better the quality, the higher the willingness to pay.

–Type of market; B2C or B2B will have very different views about the cost. B2B sales orient to the purchaser's work reputation, B2C, to the purchaser's utility.

–Non-direct alternatives; any solution that gets the job done may also be a factor. A consumer who wants to catch a cab may consider the metro if cab prices are too high.

Life’s a bundle of joy

The core of any bundling strategy is to maximize revenue. For each product or service you sell, there will be a willingness to pay. Therefore, bundling represents a combination of preference and desire to spend that enables your maximization goals.

It should be worth noting that revenue maximization is not profit maximization.

In terms of willingness to pay, one of the most popular models was developed by Peter Van Westendorp in the 1970s. This attempts to calculate a range of psychologically acceptable prices from customer survey responses to the following - “at what price would you consider the product….

–priced so low that you would feel the quality couldn’t be very good [to determine your “too cheap” price]

–to be a bargain, exceptional value for money [to determine your “cheap” price]

–starting to get expensive, i.e. requiring some thought [to determine your “expensive” price]

–so expensive so you would rule out buying it [to determine your “too expensive” price]

The conjunction area derived from these responses, along with price elasticity estimations, allow an upper and lower acceptable pricing range to be derived. More on price elasticity later in our tips section

Everyday bundles

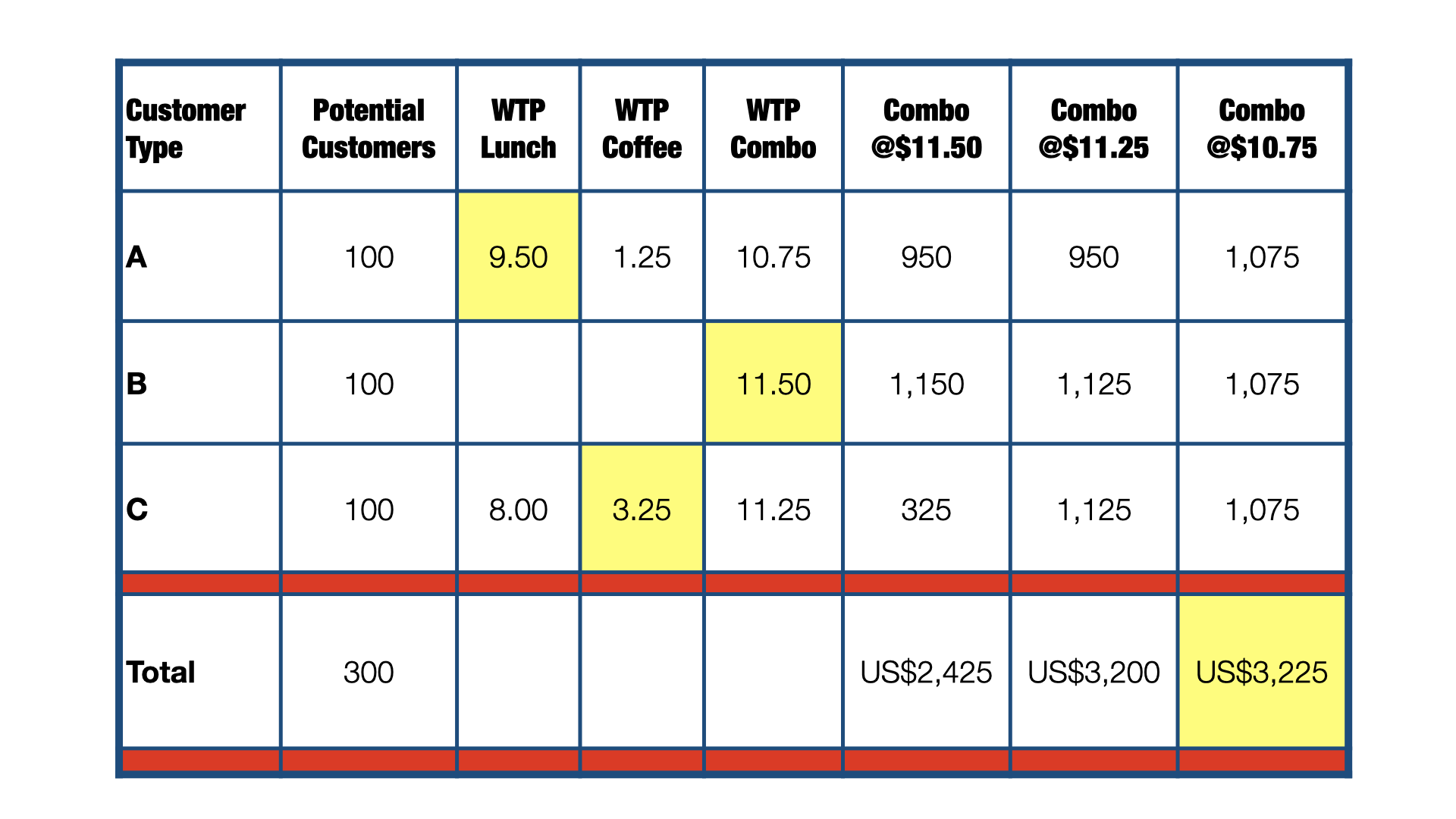

Let us assume the example of a lunch spot that also serves artisan coffee.

On the surface, the business has two products; coffee and lunch. However, with the concept of bundling, it has three; coffee, lunch, and coffee & lunch combo.

The standard prices are as follows: Lunch = $9.50, Coffee = $3.25, Combo = $11.50

…and the business has the potential to serve 300 customers during the lunch period

The combo looks great value compared to the list prices (9.50 + 3.25) = $12.75.

So why isn't everyone buying the combo?

Well, the combo WTP for C type customers is $11.25, whereas the WTP for A-type customers is only $10.75. So when the combo price is $11.50 - only B customers buy.

A and C are only buying lunch or coffee - where the list price is less or equal to their WTP for that product.

Lowering the combo price to $11.25 opens up new demand and a 30% increase in revenue by capturing C customers, but reducing the price even further to $10.75 maximizes revenues by capturing all customers' demand and achieving the optimal revenue maximization.

🐇 Additional Research 🐇

Not many writers want to explore the mathematical benefits of bundling, but Madhavan Ramanujam is an exception. His book Monetizing Innovation is superb. Dig in and enjoy.

![2x2 Evaluation Matrix [[WTP=willingness to pay]]](https://images.squarespace-cdn.com/content/v1/5e5ea20148a899440987e06c/1620748740733-G73A266OAHGI6CZ3Q57U/Eating+Complexity+Part2.002.png)