Monetization Law Number #4

Monetization is often ruled by power-law principles

Mathematic principles underly the derivation of your pricing table

Pricing tables are more science than art. We lay–out the foundations of the initial pricing table derivation.

This chapter is about how you can utilise power-law Pareto to increase your monetization through mathematical price tiering. As always we break down the chapter into a rule, the rationale and the rabbit hole.

The Rule provides a quick monetization heuristic i.e. a rule of thumb in operation, a kind of —do this— and you’ll be 80% of the way there.

Rationale explains why the rule works with deeper insights and its use in practice.

Rabbit hole provides more in-depth resources and recommendations for anyone wanting to spend more hours researching each topic.

⓵ Rule 📖

⓶ Rationale 🧠

⓷ Rabbit Hole 🐇

⓵ Rule: Monetization Law #4 📖

Always graduate your pricing in multiples e.g. 1X, 2X,4X or 1X,3X,6X…

⓶ Rationale: Monetization Law #4 🧠

The generation of an initial pricing table to establish maximal profit capture requires demand to intersect your price at the most advantageous point.

This is because your pricing tiers indicate your best approach to an estimate of your customer’s willingness to pay across the demand curve.

The diagram below is an introductory overview of the good better best thinking we introduced in monetization law#3.

This provides a graphical overview of the power-law pricing concept and how price ordinarily affects demand before we dive down the fractal rabbit hole.

a mathematical view of good–better–best pricing

⓷ Rabbit Hole: Monetization Law #4 🐇

Pareto & Power law

The power-law concept confers that a relative change in one quantity results in a relatively proportional change in another.

For pricing and business economics, this has a profound effect on the distribution of pricing points and resultant demand.

But let us go back to a more familiar rendition. Observing that 20% of the population controlled over 80% of the wealth in the mid 19th Century, the Vilfredo Pareto Principle was born.

This simplicity of approach in positioning the law of diminishing returns remains one of the key drivers for its popularity even in the tech fuelled startup era.

A frequently blogged version of the 80/20 principle being the power-law channel distribution, which states that the bulk of sales or revenue will come from only one channel.

Power Law in Action

Peter Thiel, ex PayPal, well known VC intellectual states that in a successfully scaling company, 70% of your sales will come from one channel.

To illustrate these phenomena:

Microsoft found that 80% of errors and system crashes are created by less than 20% of the pool of bugs detected.

20% of the world’s population controls more than 82% of the world’s income.

Less than 20% of patients consume over 80% of healthcare resources.

Company leaders believe that 90% of their value creation derives from less than 10% of the workforce.

Executive pay in the realms of 200 times the average employee salary also demonstrates power-law rationale - in that the top execs earn XXXXX more than the median employee

We live under a Power Law

Power Law is everywhere.

Here are some key observations for your pricing in relation to power law:

links to the demand curve and willingness to pay

a reasonable estimate of pricing tiers

fractal, in that each part of the curve has the same statistical properties as the whole

Pareto observation of 80/20 is a well-known version of power-law relationships

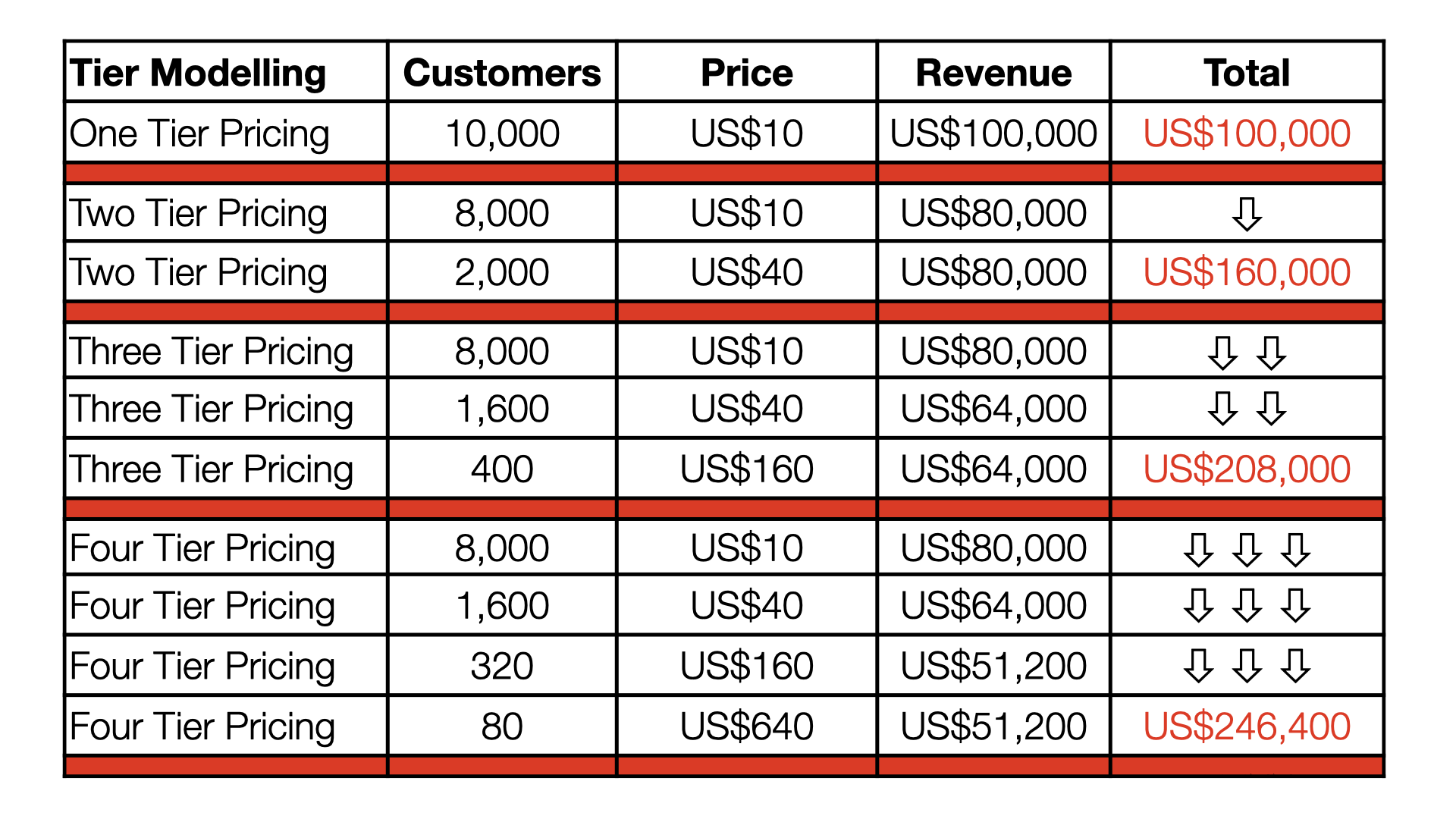

Let’s work through an example to show you the benefits of power-law pricing

this graph shows the demand at each pricing level

We’ll use an 80:20 pricing fractal, but any combination summing to 100 could apply.

80:20 fractal pricing example

If you have 10,000 customers who are buying a membership for $10 a year, and that is your only product, you’ll earn $100,000 a year.

••••But if you add a $40 membership, 80% (8,000) of your clients would still only spend $10, earning you $80,000.

But the other 20% (2,000) are probably willing to buy that $40 package instead of $10.

This generates an extra $60,000 [2,000 x ($40-$10)]. By creating this second package, your yearly earnings go up 60% to $160,000.

••••If you add a third tier at $160, 4% (400) of your clients will buy, picking up an additional $48,000. Your revenues rise again by 30%, to $208,000.

••••What if you included the fourth package at $640? Just how much more would you be earning each year?

You now have 80 clients paying $640 a year.

That’s an additional $38,400 a year, on top of what you were already earning.

Your total revenue is now $246,400.

Remember - you were only bringing in $100,000 with single-tier pricing!

In theory, you are probably leaving more than half the money on the table if you are not obeying the 80/20 or some other power-law product pricing rule.

this table shows the revenue generated from the combination of pricing tiers

Tiering Example

The example demonstrates with a customer base of 10,000, the successive benefits of tiering results in larger total revenue. Therefore capturing more value under the curve.

1,4,16,64 - 80/20 Pricing

If 80% of the results derived from just 20% of the actions, we can apply this theory with revenue. So 80% of the revenue resulted from just 20% of the customer base.

Key principles:

The formula is such that implies 1/5th of people will generally spend 4 times the money

The relationship is fractal. This essentially means it repeats until you run out of customer splitting or product offering runway.

Applying the Pareto effect on pricing, each successive cohort of customers will have the ability and willingness to spend four times (4X) the previous group.

This relationship is fractal and therefore continues up the price demand curve. The connection is that 1/5th of your customers will pay 4X more than the former cohort.

The key is to have a product or service that can scale in price and, more importantly, in value. Confusion usually limits the number of tiers offered, rather than fractal math!

An excellent example of this would be a basketball game, where court-side seats from a tiny fraction of overall space yield 16 times the price of the basic tier seating e.g., approx $1,200 court-side v’s approx $70 basic tier at Golden State Warriors.

Hubspot & Mailchimp

The pricing plans shown are now the 'business as usual’ approach adopted by most SaaS companies. The graduation of prices is the key point to note here.

Hubspot recently showed a [ X, 16X, 62X ] graduation that exhibits strong power-law pricing elements.

The earlier pricing model from many years ago shows [ X, 4X, 12X ] further demonstrates the power-law relationship and the need to vary the set-points once you acquire more customer data around feature set and willingness to pay.

Power law used by a startup unicorn [now a public co.]

Mailchimp shows a [ X, 1.5X, 30X ] graduation, with clear persona labelling to aid choice. An earlier iteration of [X, 20X ] held to the same core principles.

In later monetization laws, we explain the other nuances applied to add sophistication to the pricing tables. Anchors, decoys, nudges, persona mapping, and many more tips and tricks feature.

However, we believe the core of all pricing tables should start with the first principle of power law and then be adjusted based on actual customer usage and willingness to pay data.

The biggest ESP of them all uses power-law pricing to ramp up revenues

A guide to 80/20 almost everything!

![Power law used by a startup unicorn [now a public co.]](https://images.squarespace-cdn.com/content/v1/5e5ea20148a899440987e06c/1620650707248-ET0CBV4GEDGQQZSISQ92/Monetization+Playbooks+%236-245-255.006.png)