Monetization Law Number #20

Monetization is not an island. It links with other strategy and business model thinking

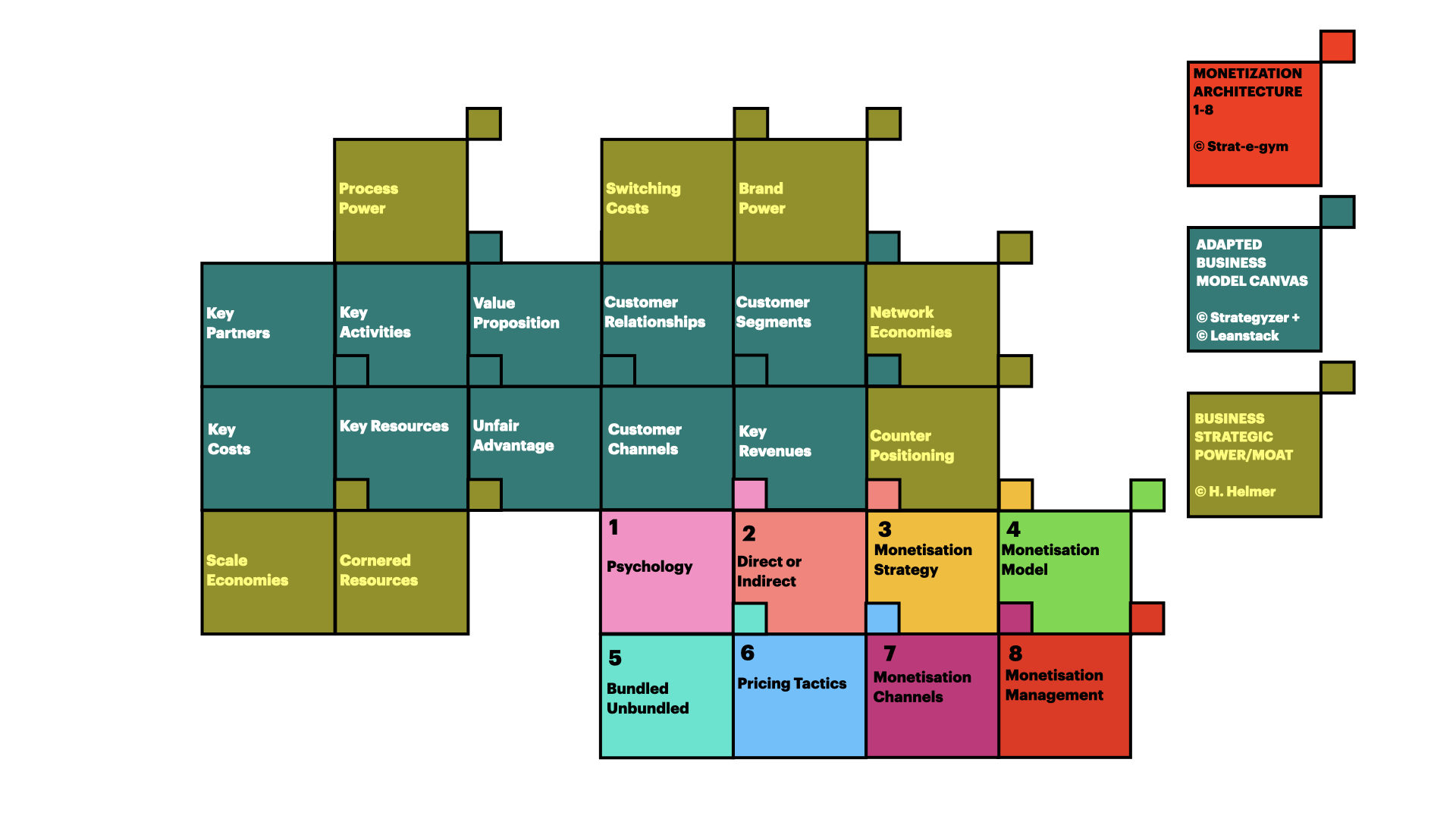

Your monetization architecture interlinks with the essential business creation and strategic power frameworks.

The process of business creation has transformed from art into a science.

This chapter explains how to use the monetization architecture in conjunction with your business creation toolkits.

The Rule provides a quick monetization heuristic i.e. a rule of thumb in operation, a kind of —do this— and you’ll be 80% of the way there.

Rationale explains why the rule works with deeper insights and its use in practice.

Rabbit hole provides more in-depth resources and recommendations for anyone wanting to spend more hours researching each topic.

⓵ Rule 📖

⓶ Rationale 🧠

⓷ Rabbit Hole 🐇

⓵ Rule: Monetization Law #20 📖

IF YOU PLAN TO CREATE, THEN CREATE A PLAN

The monetization architecture and ontology creates a visual product of your plans which can be integrated with other business model products.

⓶ Rationale: Monetization Law #20 🧠

Company formation as a science

In the last two centuries, company formation has been seen as a legal and governmental process. Legal structure and tax efficiency dominated company establishment thinking.

In the early ’90s, the emergence of technology changed all that.

The structure still had a place; however, the entrepreneur and her desire to fulfil a burning customer need took centre stage.

The rise of the startup had begun.

Business is business

So what’s all the fuss?

Trade existed for at least 4,000 years. Enterprises have started and ended. Scions of industry risen and fallen. What’s new?

The new paradigm that has emerged is that of the business as a process in itself.

Hitherto, the company was just a means to an end, primarily to trade a particular product or service.

But what if the business itself was the end and the activities acting only as a means to an end keeping it going.

Such is the view taken during the startup revolution where pivoting is taken as the business norm.

monetization architecture integration with ‘business model’ and ‘strategic power’ frameworks

1-2-3-4-5

The success stages could now be classified into;

problem discovery - finding a valuable customer problem to solve,

value proposition - generating a solution to that problem,

business modelling - configuring a repeatable way of consistently delivering the value proposition,

scaling - growth strategies to rapidly grow your market share,

power - creating an economic moat that gives your business an unfair advantage that can be maintained.

The new thinking

This new approach splits into four sections;

customer value thinking,

business model thinking,

business scale thinking, and

strategic power thinking.

Each of these areas has spurred research, commentary, and a plethora of books to generate debate, learning, and application of the new science, company building.

⓷ Rabbit Hole: Monetization Law #20 🐇

The business of business - the rise of the startup

The desire to understand every facet of company success has fuelled the growth of the startup and leadership service sector.

Consultants, specialists, books, courses, and many more resources have established, starting, scaling, and selling a business as a new discipline.

The business fraternity’s familiarity with terms such as blitzscaling, platforms, viral loops, and crossing the chasm show how far this movement has come.

Business model thinking

Over the last two decades, the science of starting a company has transformed.

Business books existed in the past, but they largely took an ex-post, personal view of the company building process as extolled by a founder or leader.

Business books focused on the achievement of the business-man, not the business model.

While inspirational, these did not fulfil the job of explaining the zero to hero desire of most company founders.

The emergence of business model theory led by Alex Osterwalder and Yves Pigneur in the early 2000’s democratized business foundation theory.

Their Business Model Canvas galvanized a community in need of a company building a theoretical structure.

The canvas centred around delivering a new value proposition to the market while explaining the levers that are central to this delivery.

As with most technology, forking the thesis led to many variants of the original model.

One crucial fork led by Ash Maurya produced the Lean Canvas, which specifically targeted the need of startups, with an increased focus on problem-solution fit and the iteration required to start and build a company.

Customer value thinking

The emergence and widespread acceptance of these canvases led to the unanswered question of where this work is done?

Previously, businesses had no function(s) tasked with adopting these innovative tools. Thus it found two homes:

–startups, in essence, those companies without extant formal business functions and;

–forward-thinking companies that established innovation hubs, innovation centres and a myriad of other tech experimentation units.

The company building science established - the search began for a means of genuinely nailing the value proposition - this being the key to the company's success.

Fortunately, a parallel stream of research around customer jobs evolved.

The jobs-to-be-done model created by Tony Ulwick and further by Clayton Christensen, focused on jobs as activities and jobs as progress, respectively.

Reasoning that the customer outcome is defined in terms of the jobs required to reach the desired outcome, they changed the product innovation thinking into an actionable model that could be adopted by many founders irrespective of their business experience.

Business scale thinking

Value proposition and delivery mechanisms set, now what?

Brian Balfour provided some answers. His experience gleaned from high growth champions of the startup era he asserted that a company is driven to financial success by a series of fits:

–Market - Product Fit (often referred to as product-market fit),

–Channel - Product Fit,

–Channel - Model Fit, and

–Market - Model Fit.

He explained that, in addition to product-market fit, companies also needed to cost-effectively fit their product to the acquisition and delivery channels, iterating their product and customer segments.

Lastly, to build a $100m company (reasoning that an average 10X multiple leads to a billion-dollar market cap), a company must fit its model to the market and determine whether to sell 100 units at 1$m or 100m units and $1.

These three methodologies formed a large part of the core startup science and revenue building, but what about profitability. That’s where monetization enters the fray.

But first, strategic power thinking.

Strategic power thinking

Having achieved the extraordinary success of actually building a company, the risk of copycat entities looms large.

In the technology arena, the reduced cost of storage, the proliferation of open-source knowledge and the abundance of venture capital have led to an extremely competitive landscape.

In 2010, you may have expected 2 or 3 rivals in your niche; now, it is more like 10!!

Think e-mail marketing tools; blink, and there are another five market entrants!

Warren Buffett and Charlie Munger know their apples. Their approach has been that of value investing - ‘buy and hold.’ But how do they select what to buy and hold?

One of their key factors is the size and defend-ability of the companies economic moat - their ability to maintain a competitive advantage to protect long term profits.

Useful, but how do you establish an economic moat in the first place.

Hamilton Helmer provided the answer.

His book explained the seven constituents of strategic power that could be utilised and developed by a company to establish an economic moat.

These are

–Scale Economies,

–Network Economies,

–Counter-Positioning,

–Switching Costs,

–Branding

–Cornered Resource, and

–Process Power.

The evolution of which now enables a company to chart a course from startup to star backed by business science.

🐇 Additional Research 🐇

The 7 Powers is an absolute must-read for new-age strategic power thinking. Hamilton Helmer has piled all his knowledge into this stand-out book that defined a go-to methodology for the next generation of analysts and founders alike.

The simplicity of text and graphics which define Business Model Generation and Value Proposition Design understate their importance.

These gems by Ales Osterwalder and Yves Pigneur created a movement around the ideation and development of the business model canvas.

Integrated monetization, business model and strategic power framework.